How Data Fabrics Allow Financial Institutions to Rapidly Respond to CEBA & COVID-19 Relief Programs

- Team

- Apr 27, 2020

- 2 min read

Updated: Jan 5, 2021

The Canadian and US federal governments recently rolled out a series of measures to help businesses and families weather the COVID-19 pandemic. While the Canadian Emergency Business Account (CEBA) program, Canada Emergency Commercial Rent Assistance (CECRA) program, and initiatives under the CARE Act in the United States are all meant to provide relief, the reality is that organizations are struggling to keep up with the timeliness and demand of the loans, changing business rules, and reporting requirements.

Fortunately, Cinchy can help.

We recently worked with Concentra, a national wholesale bank, to develop a COVID-19 relief loan solution that leverages our Cinchy Data Fabric. This gave Concentra the platform they needed to start accepting loans in just over one week. Concentra now has the flexibility to integrate our solution into downstream systems and respond to funding rule changes from the government in real-time.

Join us every Thursday for our Data Fabric learning series as we discuss Data Fabric concepts, roadmaps, best practices, and demos, alongside special guests.

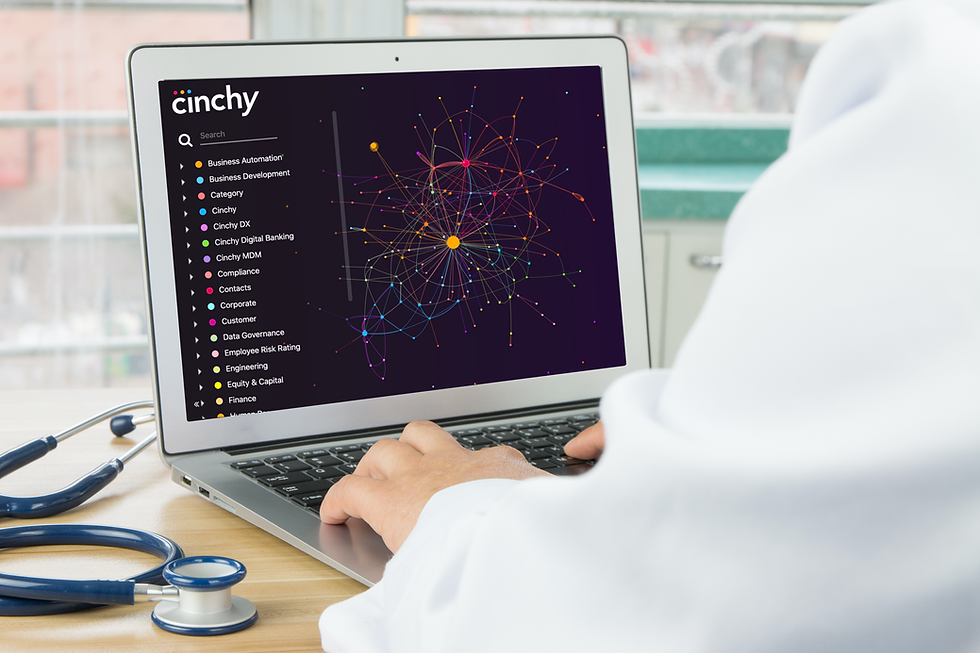

What makes Cinchy different?

Cinchy’s Data Fabric offers an alternative to the 40-year old paradigm of buying, building, and integrating rigid applications for every single project. Companies still using this outdated paradigm find it’s costing more time and money than ever in an environment that demands speed, agility, and cost reduction. They’re being stretched thin, with much of the onus on employees managing processes and responding to rapidly changing requirements manually through Excel or hastily developed code—an approach that doesn’t scale up, won’t hold up to the rigors of ongoing monitoring, and puts personal banking data at risk.

We see the need for a bridging technology that allows both the private and public sectors to collaborate on the data underpinning these funding programs. The Cinchy Data Fabric does just that, without compromising data protection or privacy.

Cinchy not only enables a rapid response for time-sensitive emergency programs, but allows for the ongoing use of data in a secure platform where it can always be accessed using non-proprietary methods. This simply is not possible with today's model, where every system needs its own datastore and you're forced to spend significant amounts on integration and its byproducts (ETLs, APIs, Reconciliation, MDM, and the like).

Despite their radically different approach, Data Fabrics are already being leveraged by some of North America’s largest financial institutions as an alternative to data sharing—and with great results due to the Cinchy Data Fabric’s unique benefit of Network Effects for business.

What does that mean? Simply put, the more data you feed into your Cinchy Data Fabric, the more efficient it becomes. While traditional business solutions improve productivity in a linear way, Cinchy gives you the tools to improve exponentially, while providing flexibility, security, and control when it comes to data.

And there’s only one technology that provides all of this.

Join us every Thursday for our Data Fabric learning series as we discuss Data Fabric concepts, roadmaps, best practices, and demos, alongside special guests.

.png)

Comments